Introduction – A simple idea with outsized results

If you want fewer fees and steadier results, Vanguard mutual funds are worth a serious look. Vanguard’s core promise is straightforward: reduce costs, diversify broadly, and avoid chasing short-term performance. That approach doesn’t make headlines – but over decades it has moved mountains for ordinary investors.

Vanguard was founded with a unique ownership structure designed to align the firm’s incentives with investors’ outcomes, a model that helps explain why low fees and investor-first policies are baked into its products. Vanguard

What exactly are Vanguard mutual funds?

Vanguard mutual funds are pooled investments managed by The Vanguard Group that offer access to stocks, bonds, international markets, and target-date mixes. Many of Vanguard’s most popular funds are index funds – they track an index rather than try to beat it – which keeps turnover and costs low. Vanguard also offers actively managed funds and target-retirement funds that follow the same cost-conscious discipline.

Vanguard’s fund-owned corporate structure means the company returns profits to fund shareholders through lower expense ratios and better economies of scale, rather than external shareholder payouts. Vanguard

Why fees matter – the quiet compounding effect

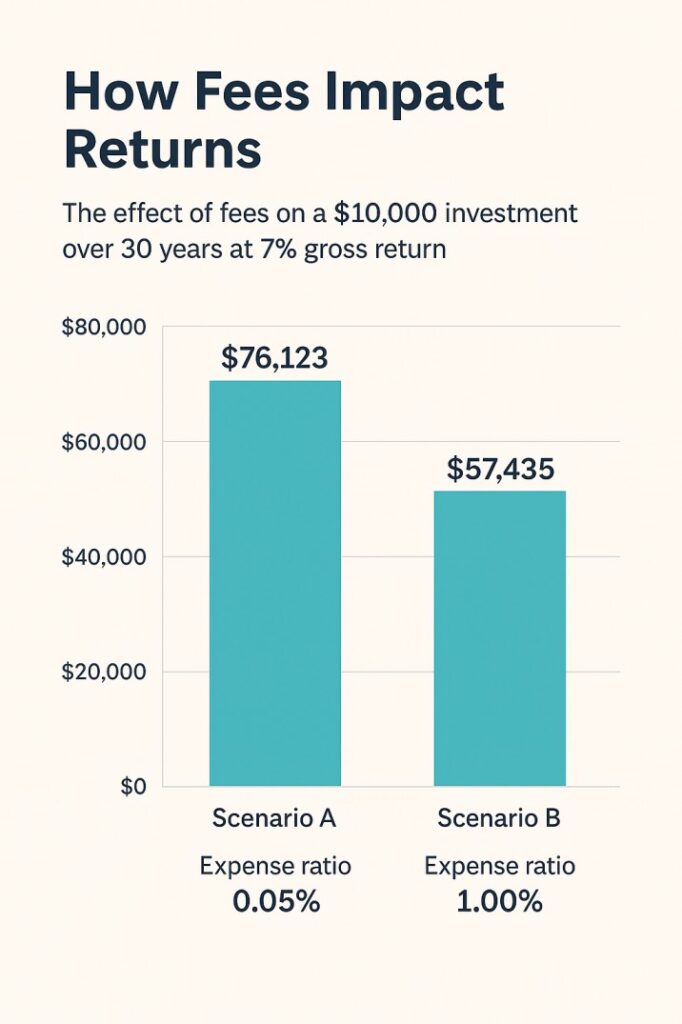

Fees are the hidden drag on returns. Two funds producing the same pre-fee performance will leave very different results in an investor’s pocket if one charges much more. Vanguard’s persistent focus on low expense ratios is a central reason many financial planners use Vanguard funds as core portfolio holdings.

For concrete examples, flagship index funds such as the Vanguard Total Stock Market Index Fund (VTSAX) and the Vanguard 500 Index Fund (VFIAX) have expense ratios that are tiny compared with many active mutual funds, which adds up over decades. Vanguard+1

The data: active managers usually don’t win

If you’re wondering whether paying more for an active manager is worth it, the long-term evidence is sobering. The SPIVA (S&P Indices Versus Active) scorecards routinely show that a majority of active managers fail to beat their benchmarks over long time horizons. That doesn’t mean active funds are useless, but it does explain why Vanguard emphasizes broad, low-cost index exposure as a reliable core strategy. S&P Global

How Vanguard mutual funds differ from “traditional” mutual funds

| Feature | Vanguard Mutual Funds | Typical Traditional Mutual Funds |

|---|---|---|

| Corporate structure | Fund-owned (investor-aligned) | Corporate-owned |

| Cost focus | Very low expense ratios | Often higher (marketing, distribution) |

| Philosophy | Index-first, long-term discipline | Often active, performance-focused |

| Turnover | Low | Usually higher |

| Typical investor fit | Long-term, buy-and-hold | Investors seeking active alpha |

This table summarizes why many financial advisors use Vanguard funds as the backbone of retirement and long-term portfolios.

Popular Vanguard mutual funds (and how investors use them)

- Vanguard Total Stock Market Index Fund (VTSAX) – a single fund that offers exposure to the entire U.S. equity market. Often used as a core equity holding. Vanguard

- Vanguard 500 Index Fund (VFIAX) – tracks the S&P 500 for large-cap U.S. exposure. Good for investors who want the large-cap core. Vanguard

- Vanguard Total International Stock Index Fund – broad international equity exposure for global diversification.

- Vanguard Total Bond Market Index Fund – core fixed-income holding for balance and risk reduction.

- Vanguard Target Retirement Funds – “set-and-forget” portfolios that gradually shift toward bonds as the target date approaches.

Each fund is often recommended as part of a 2-3 fund core portfolio (e.g., Total Stock Market + Total International + Total Bond) because of simplicity and low cost.

Realistic investor takeaways – what works in practice

- Control what you can: fees, allocation, and behavior. Vanguard excels at the first two; you control the third.

- Simplicity wins: A simple allocation built from a few Vanguard funds reduces decision fatigue and emotional trading.

- Behavioral edge: Low-cost, broad funds reduce the temptation to “chase” strategies that underperform over time. Vanguard research and industry studies highlight investor behavior as a major determinant of outcomes. Vanguard

Costs vs. active management – when to consider active funds

There are valid reasons to consider active funds: specific niche markets, tax-sensitive strategies, or access to specialized expertise. But the default for most investors should be low-cost index funds unless a clear, data-driven reason exists for paying higher fees. Vanguard itself offers competitively priced active funds -the difference is transparency and rigor around costs and incentives. Vanguard

Practical portfolio examples (simple & scalable)

Conservative (retirement near): 30% VTSAX / 20% Total International / 50% Total Bond Market

Balanced (10+ years): 60% VTSAX / 30% Total International / 10% Total Bond Market

Aggressive (long horizon): 80% VTSAX / 20% Total International

These allocations are examples – adjust for age, risk tolerance, and goals. The beauty of Vanguard funds is that they make scaling up (larger positions) inexpensive and straightforward.

Recent developments worth noting

Vanguard periodically trims fees across certain funds to pass savings to investors and stay competitive, demonstrating its ongoing emphasis on cost reduction. These fee moves and the firm’s large asset base reinforce its price leadership position. Reuters

Common myths debunked

- “Low cost = low quality.” Not true. Low cost simply means more of your return stays invested-history shows low-cost funds often outperform after fees.

- “Index funds can’t beat active managers.” Most active managers fail to outperform after fees, which makes low-cost index funds a strong base for most investors. S&P Global

- “Vanguard is only for beginners.” Institutional investors, advisors, and retirement plans use Vanguard funds precisely because of their cost and scale.

Conclusion – Small choices, big results

Vanguard mutual funds aren’t a magic bullet; they’re a practical, evidence-based way to build wealth over the long run. If you prioritize low costs, broad diversification, and behavioral discipline, Vanguard provides tools that make those priorities easy to put into action.

Disclaimer: The content provided is for educational and informational purposes only and should not be considered financial, investment, insurance, or legal advice.