If you’re a high earner in the U.S., chances are you’ve heard this frustrating sentence about Backdoor Roth IRA before:

“You make too much money to contribute to a Roth IRA.” That’s where the Backdoor Roth IRA comes in.

Used correctly, a Backdoor Roth IRA allows high-income professionals-doctors, engineers, executives, business owners-to legally move money into a Roth IRA and enjoy tax-free growth for life. Used incorrectly, it can trigger unexpected taxes and IRS headaches.

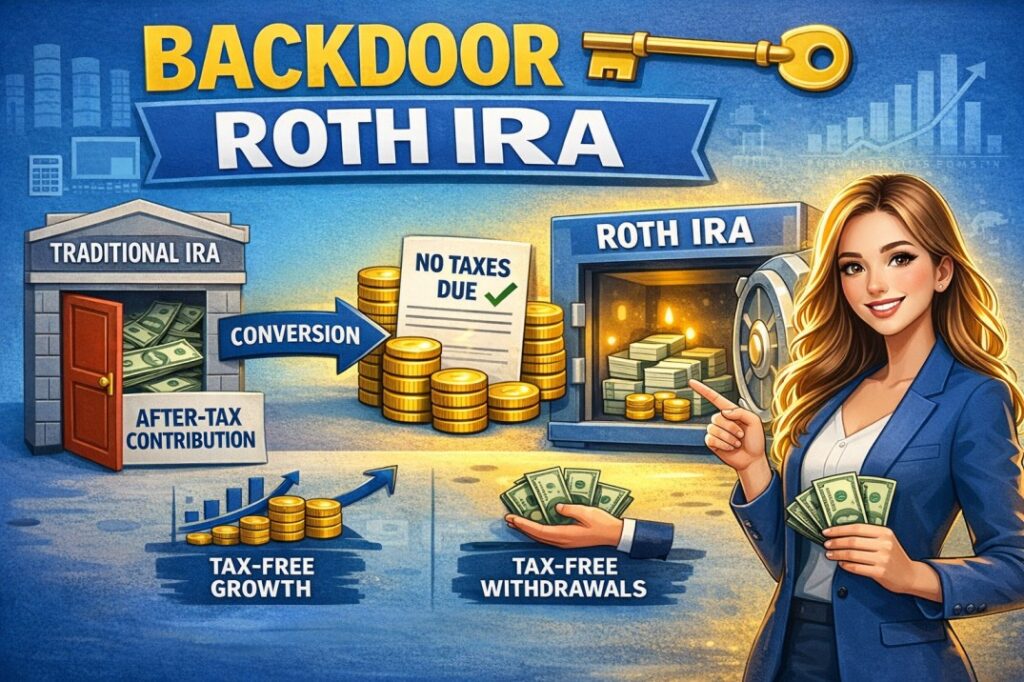

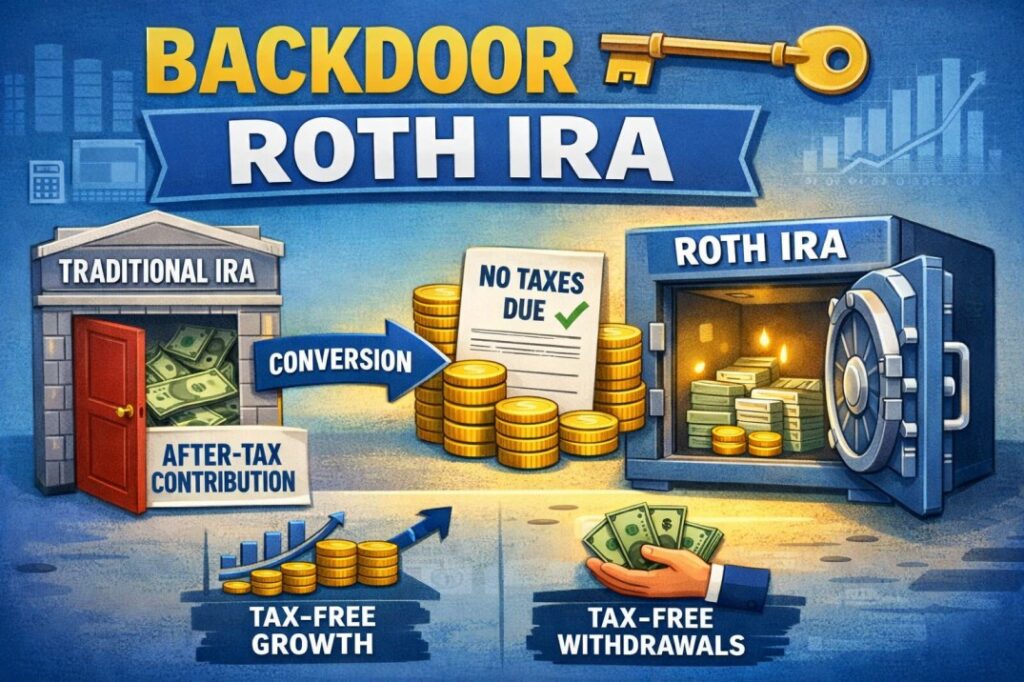

What Is a Backdoor Roth IRA?

It is not a special account created by the IRS. It’s a two-step strategy that takes advantage of existing tax rules:

- Contribute after-tax money to a Traditional IRA

- Convert that money to a Roth IRA

Why does this work?

Because while the IRS limits who can contribute directly to a Roth IRA, there is no income limit on Roth conversions.

So even if your income is too high for a direct Roth contribution, you can still legally get money into a Roth IRA using this method.

Key takeaway: The Backdoor Roth IRA is a workaround-not a loophole-and is widely used by high earners.

Why High Earners Use a Backdoor Roth IRA

For many professionals, the Backdoor Roth IRA solves three major problems.

1. Tax-Free Growth

Once money is inside a Roth IRA:

- Investment growth is tax-free

- Qualified withdrawals in retirement are tax-free

That’s powerful if you expect higher taxes in the future.

2. No Required Minimum Distributions (RMDs)

Unlike Traditional IRAs, Roth IRAs don’t force withdrawals during your lifetime. This gives you more flexibility in retirement and estate planning.

3. Tax Diversification

Having money in taxable, tax-deferred, and tax-free accounts gives you control over your tax bill in retirement.

2026 Contribution & Income Limits (Quick Snapshot)

| Category | 2026 Limit |

|---|---|

| IRA Contribution Limit (Under 50) | $7,500 |

| IRA Contribution Limit (50+) | $8,600 |

| Roth IRA Income Limit (Single) | Phases out ~$153k–$168k |

| Roth IRA Income Limit (Married Filing Jointly) | Phases out ~$242k–$252k |

⚠️ Even if you’re above the Roth income limits, you can still use this strategy.

Step-by-Step: How to Do a Backdoor Roth IRA

Step 1: Open a Traditional IRA

If you don’t already have one, open a Traditional IRA at a brokerage like Fidelity, Vanguard, or Schwab.

✔ This account will temporarily hold your after-tax contribution.

Step 2: Make a Nondeductible Contribution

Contribute up to the annual IRA limit without taking a tax deduction.

- This is critical

- You must treat this as after-tax money

💡 Tip: Make sure your tax software or CPA records this correctly.

Step 3: Convert to a Roth IRA

Convert the Traditional IRA funds to a Roth IRA.

- Many people do this within days

- Converting quickly minimizes taxable earnings

There is no required waiting period between contribution and conversion.

Step 4: File IRS Form 8606 (Non-Negotiable)

Form 8606 tells the IRS:

- You made a nondeductible contribution

- How much of your conversion is tax-free

Failing to file this form is one of the most common Backdoor Roth IRA mistakes.

Step 5: Keep Records

Always keep copies of:

- Form 8606

- Contribution confirmations

- Conversion confirmations

This protects you from double taxation later.

The Pro-Rata Rule (The #1 Trap)

The pro-rata rule is where most people get burned.

What Is the Pro-Rata Rule?

The IRS views all your IRAs as one combined account for tax purposes.

That includes:

- Traditional IRAs

- SEP IRAs

- SIMPLE IRAs

If you have pre-tax money in any of these accounts, part of your Backdoor Roth IRA conversion becomes taxable.

Simple Example

- $90,000 in pre-tax IRAs

- $10,000 nondeductible contribution

Total IRA balance = $100,000

Only 10% of your conversion is tax-free

90% is taxable

How to Avoid the Pro-Rata Rule

The most effective solution:

- Roll pre-tax IRA money into a 401(k) (if your employer plan allows it)

Once pre-tax money is out of your IRAs:

- Your Backdoor Roth IRA conversion can be nearly tax-free

Backdoor Roth IRA vs Direct Roth IRA

| Feature | Direct Roth IRA | Backdoor Roth IRA |

|---|---|---|

| Income Limits | Yes | No |

| Complexity | Low | Moderate |

| Tax Filing | Simple | Requires Form 8606 |

| Best For | Moderate earners | High earners |

Common Mistakes (Avoid These)

- ❌ Ignoring existing IRA balances

- ❌ Forgetting Form 8606

- ❌ Assuming conversions are always tax-free

- ❌ Withholding taxes from the conversion itself

- ❌ Poor record-keeping

One overlooked form or old IRA account can turn a smart strategy into a costly one.

Advanced Strategy: The Mega Backdoor Roth (Briefly)

Some employer 401(k) plans allow:

- After-tax contributions

- In-plan Roth conversions

This is called the Mega Backdoor Roth and can allow tens of thousands more per year into Roth accounts.

👉 This requires specific plan features-check your Summary Plan Description.

Is a Backdoor Roth IRA Right for You?

A Backdoor Roth IRA makes sense if:

- You’re a high earner blocked from direct Roth contributions

- You expect higher future tax rates

- You want tax-free retirement income

- You can manage or eliminate pre-tax IRA balances

It may not be ideal if:

- You expect a much lower retirement tax rate

- You have large pre-tax IRAs and no 401(k) rollover option

- You prefer ultra-simple investing strategies

Final Thoughts:

The Backdoor Roth IRA is one of the most valuable retirement strategies available to high earners—but only if you respect the rules.

Understand the pro-rata rule, file Form 8606, and plan ahead. Done right, this strategy can quietly build hundreds of thousands of dollars in tax-free retirement wealth.